How to Calculate Your Commute Cost in the UK 2026

Here’s a startling fact: The average UK worker spends over £3,000 per year just getting to and from work yet most people have no idea what their true commute cost actually is. Whether you’re considering a new job offer, negotiating a salary, or trying to save money, understanding your real commute expenses is absolutely essential for making smart financial decisions.

Why Your Commute Cost Matters More Than You Think

Let me paint you a picture. Sarah receives a job offer with a £5,000 salary increase. Sounds brilliant, right? But the new office is 15 miles further from her home. After calculating her real commute costs, she discovers that the extra travel expenses eat up £4,200 of that raise—leaving her with just £800 more in her pocket.

This scenario plays out thousands of times across the UK because people simply don’t calculate the true financial impact of their daily journey to work.

The Real Cost of Commuting in 2026

According to recent data, the average UK commuter faces these costs:

- Car commuters: £3,400 – £4,500 per year (depending on distance and vehicle)

- Train commuters: £3,800 – £6,100 per year (higher in London and Southeast)

- Bus commuters: £1,200 – £2,400 per year

- Multi-modal commuters: £2,800 – £5,000 per year

These figures represent thousands of hours of work each year time you’re essentially working for free just to get to your actual job. When you break down your take-home pay, your commute can reduce your effective hourly rate by 10-20%.

💡 The Hidden Impact on Your Real Salary

Your commute doesn’t just cost money—it costs time. The average UK commute is 59 minutes per day (return journey). Over a year, that’s:

- 245 hours (approximately 31 working days) spent travelling

- Time you could be earning, learning, or enjoying life

- Additional stress and reduced wellbeing

When calculating your real salary value, you must factor in both the financial and time costs of your commute.

Why Most People Underestimate Their Commute Costs

Here’s the problem: when people think about commute costs, they typically only consider the obvious expenses—fuel or train tickets. But the real cost includes:

- Vehicle depreciation (losing value every mile you drive)

- Insurance premiums (affected by annual mileage)

- Maintenance and servicing (increasing with mileage)

- Parking fees (daily or monthly)

- Congestion charges (in London and other cities)

- Coffee and food purchased on the go

- Wear and tear on clothing and accessories

When you add all these up, your true commute cost can be 40-60% higher than you initially thought.

Calculating Fuel Costs: The Complete Formula

If you drive to work, fuel is your most visible expense but calculating it accurately requires more than just glancing at the petrol pump.

Step-by-Step Fuel Cost Calculation

Here’s the precise method for calculating your annual fuel costs:

Annual Fuel Cost Formula

Step 1: Calculate your daily commute distance (return journey)

Step 2: Find your vehicle’s fuel consumption (MPG)

Step 3: Get current fuel price per litre

Step 4: Apply the formula

Note: 4.546 converts UK gallons to litres

2026 UK Fuel Prices

As of January 2026, average UK fuel prices are:

| Fuel Type | Average Price per Litre | Regional Variation |

|---|---|---|

| Unleaded Petrol | 135p | 128p – 145p |

| Diesel | 142p | 135p – 152p |

| Premium Petrol | 152p | 145p – 165p |

💼 Example: James’s Fuel Calculation

James drives 20 miles each way to work (40 miles total daily). He works 5 days a week, 47 weeks per year (accounting for holidays). His car does 45 MPG, and petrol costs 135p per litre.

Calculation:

- Daily commute: 40 miles

- Annual commute miles: 40 × 5 × 47 = 9,400 miles

- Gallons used: 9,400 ÷ 45 = 208.89 gallons

- Litres used: 208.89 × 4.546 = 949.6 litres

- Fuel cost: 949.6 × £1.35 = £1,282 per year

That’s over £100 per month just on fuel to get to work!

Electric Vehicle (EV) Charging Costs

If you drive an electric vehicle, your “fuel” cost calculation is different but equally important:

EV Charging Cost Formula

Home Charging (Off-Peak):

Public Charging: Typically 2-3× more expensive than home charging

Average EV efficiency: 3-4 miles per kWh

Home electricity (off-peak): 7-12p per kWh

Public rapid charging: 65-85p per kWh

Your actual MPG (or miles per kWh for EVs) varies significantly based on:

- Driving style (aggressive acceleration reduces efficiency by 15-30%)

- Traffic conditions (stop-start traffic reduces efficiency)

- Vehicle age and condition

- Weather (cold weather reduces EV range by 20-40%)

- Air conditioning and heating use

Use your vehicle’s actual consumption data rather than manufacturer claims for more accurate calculations.

Public Transport: Train, Bus, and Tube Costs

Public transport costs might seem straightforward—just the ticket price, right? But season tickets, daily caps, and different fare zones make it more complex than you’d think.

Train Commuting Costs

Train fares in the UK are among the highest in Europe, and they vary dramatically based on distance, time of travel, and whether you’re travelling in peak or off-peak hours.

Season Tickets vs. Daily Tickets

For regular commuters, the calculation is crucial:

Season Ticket Break-Even Point

Weekly ticket: Usually cheaper if you travel 3+ days per week

Monthly ticket: Usually cheaper if you travel 8+ days per month

Annual ticket: Typically saves 10-15% compared to monthly tickets

💼 Example: Emma’s Train Season Ticket

Emma commutes from Reading to London Paddington.

Ticket Options (2026):

- Daily peak return: £47.40

- Weekly season ticket: £185.00

- Monthly season ticket: £709.00

- Annual season ticket: £7,372.00

Emma’s Calculation:

- Works 5 days per week, 47 weeks per year

- Annual cost using daily tickets: £47.40 × 5 × 47 = £11,139

- Annual season ticket: £7,372

- Annual saving with season ticket: £3,767

London Transport Costs

London has its own unique fare structure with zones and daily caps:

| Travel Type | Pay-As-You-Go | Daily Cap | Monthly Cost |

|---|---|---|---|

| Bus/Tram (Single) | £1.75 | £5.25 | ~£110 |

| Tube Zones 1-2 | £3.20 peak | £8.50 | ~£170 |

| Tube Zones 1-3 | £3.90 peak | £10.00 | ~£200 |

| Tube Zones 1-6 | £6.30 peak | £14.90 | ~£298 |

Transport for London increased fares by approximately 5.8% in March 2026. If you’re using older budget figures, update them to avoid underestimating your costs.

Bus Commuting Costs

Bus travel is typically the most affordable public transport option:

- England (outside London): £3 single fare cap on most routes (extended through 2026)

- London buses: £1.75 per journey, £5.25 daily cap

- Scotland: £2.50 single fare cap on most routes

- Wales: Varies by region, typically £2-4 per journey

💼 Example: Marcus’s Bus Commute

Marcus takes two buses to get to work in Manchester (one bus each way, changing once).

Daily cost: 4 journeys × £3 = £12

Weekly cost: £12 × 5 = £60

Annual cost: £60 × 47 = £2,820

By purchasing a weekly bus pass for £22, Marcus reduces his annual cost to £1,034—saving £1,786 per year!

Multi-Modal Commuting

Many commuters combine different transport methods (e.g., drive to station, then train). Don’t forget to include:

- Station parking costs (typically £3-15 per day)

- Park-and-ride fees

- Connecting bus or tram fares

- Walking time between connections

🧮 Calculate Your Exact Commute Cost

Stop guessing and get accurate figures for your specific journey. Our comprehensive calculator includes fuel, public transport, parking, and hidden costs to show you the complete picture.

Calculate My Commute Cost →The Hidden Costs Everyone Forgets

Here’s where most people’s calculations fall apart. The obvious costs—fuel or train tickets—are just the tip of the iceberg. Let me reveal the hidden expenses that could be costing you hundreds or even thousands per year.

1. Vehicle Depreciation

Every mile you drive reduces your car’s value. This is often the single largest hidden cost of car commuting.

Depreciation Calculation

Average UK car depreciation: 15-20% in the first year, then 10-15% per year after.

However, high mileage accelerates this. A car with 100,000 miles is worth approximately 30-40% less than an identical car with 50,000 miles.

For a 20-mile daily commute: £600 – £1,200 per year in depreciation

2. Insurance Premium Increases

Your annual mileage significantly affects your insurance premium. Insurers typically ask for your estimated annual mileage, and higher mileage means higher premiums.

| Annual Mileage | Average Premium Impact |

|---|---|

| Under 5,000 miles | Baseline (lowest) |

| 5,000 – 10,000 miles | +5-10% premium |

| 10,000 – 15,000 miles | +10-20% premium |

| Over 15,000 miles | +20-35% premium |

With the average UK car insurance premium around £562 per year, a high-mileage commuter could pay an extra £100-200 annually compared to a low-mileage driver.

If you significantly underestimate your mileage to save on premiums, your insurer may refuse to pay out in the event of a claim. Always provide accurate mileage estimates, and notify your insurer if your commute changes.

3. Maintenance and Servicing

More miles means more wear and tear. High-mileage commuters face:

- More frequent servicing: Most cars need servicing every 10,000-12,000 miles or annually

- Faster tyre wear: Tyres typically last 20,000-30,000 miles (£300-600 per set)

- Brake replacement: Brake pads every 30,000-70,000 miles (£150-300)

- Timing belt: Every 60,000-100,000 miles (£300-800)

- General wear items: Wiper blades, bulbs, filters

Average Maintenance Cost per Mile

Medium car: £0.08 – £0.14 per mile

Large car/SUV: £0.12 – £0.20 per mile

4. Parking Costs

If you have to pay for parking at work or at the train station, this adds up frighteningly quickly:

💼 Example: Parking Cost Reality Check

Workplace parking: £5 per day

Working days per year: 235 days

Annual parking cost: £5 × 235 = £1,175

In London city centre, workplace parking can cost £15-30 per day, resulting in annual costs of £3,500 – £7,000!

5. Congestion and Clean Air Charges

If your commute takes you through charging zones:

- London Congestion Charge: £15 per day (£17.50 if not paid by midnight)

- London Ultra Low Emission Zone (ULEZ): £12.50 per day for non-compliant vehicles

- Birmingham Clean Air Zone: £8 per day for non-compliant vehicles

- Bath Clean Air Zone: £9 per day for non-compliant vehicles

Driving a non-ULEZ compliant car into central London five days a week costs:

6. MOT and Road Tax

While not strictly commute-specific, higher-mileage vehicles:

- MOT: £54.85 annually (more likely to require repairs with higher mileage)

- Road tax (VED): £20 – £600+ annually depending on vehicle emissions

- MOT repairs: Average £150-400 per year for high-mileage vehicles

7. Time Cost

While not a direct financial cost, your commute time has significant value:

💡 The True Cost of Time

Average UK commute: 59 minutes return journey

Working days per year: 235

Total commute time per year: 231 hours (29 working days)

If your hourly rate is £15, the time value of your commute is £3,465 per year. If you earn £25/hour, it’s £5,775 per year.

This “invisible cost” should factor into job decisions, especially when comparing a higher-paying job with a longer commute versus a lower-paying job closer to home.

Your Total Annual Commute Cost

Now let’s bring everything together. Here’s how to calculate your complete annual commute cost, including all the hidden expenses we’ve discussed.

The Complete Calculation Framework

Total Annual Commute Cost Formula

For Car Commuters:

- + Fuel costs

- + Depreciation

- + Insurance premium increase

- + Maintenance and servicing

- + Parking fees

- + Congestion/clean air charges

- + MOT and road tax (proportional to commute miles)

- + Incidental costs (coffee, snacks)

- = Total Annual Commute Cost

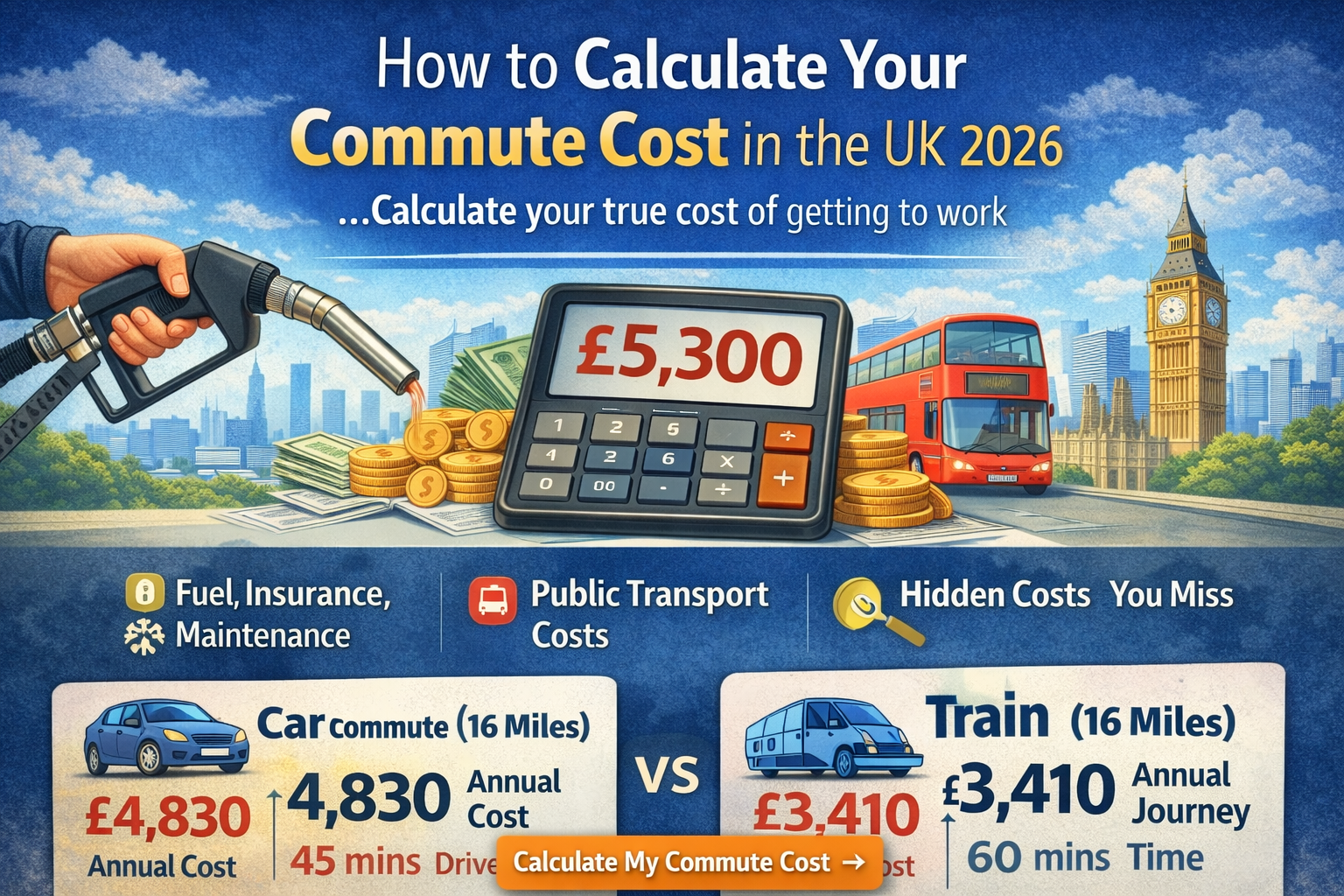

💼 Complete Example: Rachel’s True Commute Cost

Rachel drives 18 miles each way (36 miles daily) to work in her 2020 Ford Focus. Let’s calculate her complete annual cost:

Basic Information:

- Daily commute: 36 miles

- Working days: 235 (5 days/week, 47 weeks)

- Annual commute mileage: 8,460 miles

- Car MPG: 50

- Fuel price: £1.35/litre

Detailed Cost Breakdown:

| Fuel | £1,168 |

| Depreciation (£0.20/mile) | £1,692 |

| Insurance increase (15% higher) | £84 |

| Maintenance (£0.09/mile) | £761 |

| Parking at work (£3/day) | £705 |

| MOT & repairs (proportional) | £180 |

| Incidentals (coffee, snacks) | £240 |

| Total Annual Cost | £4,830 |

Per month: £402.50

Per working day: £20.55

Rachel thought her commute cost around £100/month in fuel. The reality? Nearly £400/month—four times what she estimated!

Public Transport Complete Cost

💼 Complete Example: David’s Train Commute

David commutes by train from Brighton to London Victoria.

Cost Breakdown:

| Annual season ticket | £5,324 |

| London Tube travel (daily cap zones 1-2) | £1,998 |

| Parking at Brighton station (£8/day) | £1,880 |

| Coffee and breakfast (£5/day, 3 days/week) | £705 |

| Total Annual Cost | £9,907 |

Per month: £825.58

Per working day: £42.16

Financial experts recommend your commute should cost no more than 10-15% of your gross salary. If it’s higher, you may want to consider:

- Negotiating a higher salary

- Requesting a travel allowance or remote work days

- Finding accommodation closer to work

- Seeking employment nearer to home

Comparing Different Commute Methods

Should you drive or take the train? Is cycling practical? Let’s compare the real costs and benefits of different commute methods for the same journey.

Case Study: Same Route, Different Methods

Let’s compare four different ways to make the same 15-mile commute to central Birmingham:

| Method | Time | Annual Cost | Pros | Cons |

|---|---|---|---|---|

| Drive (Petrol Car) | 35-50 mins | £3,850 | Door-to-door, flexible timing, comfortable | Stressful in traffic, parking costs, depreciation |

| Train | 45-55 mins | £2,840 | Productive time, no driving stress, reliable | Fixed schedule, crowded peak times, station parking |

| Bus | 60-75 mins | £1,410 | Cheapest option, productive time | Longest journey, less reliable, less comfortable |

| Cycling | 60-75 mins | £350 | Exercise, cheapest, reliable timing, no parking issues | Weather-dependent, shower facilities needed, safety concerns |

| E-Bike | 45-55 mins | £580 | Fast, exercise, very cheap running costs | High initial cost, charging needed, theft risk |

The Hidden Value of Public Transport

While public transport might seem more expensive than driving (when you only count fuel), there are hidden benefits:

- Productive time: Read, work, study, or relax during your journey

- Zero stress: No traffic frustration or parking battles

- Predictable costs: Fixed annual expense, easy to budget

- No depreciation: Your car stays newer for longer

- Lower insurance: Lower annual mileage = cheaper premiums

- Environmental benefits: Significantly lower carbon footprint

Cost Per Mile Comparison

Here’s what each commute method actually costs per mile travelled:

| Method | Cost Per Mile | Break-Even Distance |

|---|---|---|

| Petrol car (full cost) | £0.50 – £0.65 | – |

| Diesel car (full cost) | £0.45 – £0.60 | – |

| Electric car (full cost) | £0.35 – £0.45 | – |

| Train (typical commute) | £0.40 – £1.20 | Under 12 miles: often cheaper to drive |

| Bus | £0.15 – £0.35 | Usually cheapest for any distance |

| Cycling | £0.03 – £0.08 | Always cheapest (if practical) |

Tax Relief and Mileage Allowances

Here’s some good news: you might be able to claim tax relief on your commute costs in certain circumstances. Understanding these allowances could save you hundreds of pounds per year.

HMRC Approved Mileage Allowance Payments (AMAPs)

If you use your personal vehicle for business travel (not your regular commute to your normal workplace), HMRC allows tax-free mileage payments:

| Vehicle Type | First 10,000 Miles | Over 10,000 Miles |

|---|---|---|

| Cars and vans | 45p per mile | 25p per mile |

| Motorcycles | 24p per mile | 24p per mile |

| Bicycles | 20p per mile | 20p per mile |

Regular commute to your normal workplace: NOT eligible for mileage allowance

Business travel to temporary workplaces: ELIGIBLE for mileage allowance

For detailed calculations, see our Mileage Allowance Relief Calculator.

When Can You Claim Mileage Relief?

You can claim mileage allowance in these situations:

- Temporary workplace travel: Visiting clients, attending meetings at different locations

- Multiple workplace travel: If you have no fixed workplace and travel to various locations

- Site-based workers: Construction workers, home care workers, etc., travelling between sites

💼 Example: Sophie’s Mileage Relief Claim

Sophie is a community nurse who travels to patients’ homes. She drives 12,000 business miles per year in her personal car.

HMRC approved rate:

First 10,000 miles: 10,000 × £0.45 = £4,500

Additional 2,000 miles: 2,000 × £0.25 = £500

Total allowable: £5,000

Employer pays: £0.30 per mile = £3,600

Sophie can claim tax relief on the difference:

£5,000 – £3,600 = £1,400

Tax relief at 20% = £280 back from HMRC

Use our Mileage Allowance Relief Calculator to work out your potential claim.

Cycle to Work Scheme

The government’s Cycle to Work Scheme allows you to buy a bike and accessories tax-free through salary sacrifice, saving 25-40% on the cost.

Cycle to Work Scheme Savings

How it works:

- Your employer buys the bike

- You repay through salary deductions (before tax and NI)

- Repayment period: typically 12-18 months

- Maximum value: Usually £1,000, some employers allow up to £3,000

Higher rate taxpayer: Save 42% (40% income tax + 2% NI)

💼 Example: Tom’s E-Bike Savings

Tom wants to buy a £1,500 e-bike through the Cycle to Work Scheme. He’s a basic rate taxpayer.

Retail price: £1,500

After salary sacrifice savings (32%): £1,020

Total saving: £480

Plus, he saves £3,200 per year compared to driving, meaning the bike pays for itself in under 5 months!

Season Ticket Loans

Many employers offer interest-free season ticket loans, allowing you to spread the cost of an annual ticket over 12 months while still benefiting from the annual ticket discount.

- Pay monthly instead of a lump sum

- Get the annual ticket discount (typically 10-15% cheaper)

- Interest-free borrowing

- Tax-free benefit (no benefit-in-kind tax)

10 Ways to Reduce Your Commute Costs

Now that you understand the true cost of your commute, let’s explore practical strategies to reduce it. Some of these tactics could save you thousands of pounds per year.

1. Negotiate Remote Working Days

Even one day per week working from home saves 20% of your commute costs—potentially £600-1,000+ annually.

Present remote working as a business benefit: increased productivity, reduced sick days, better work-life balance. Use our Remote Work Savings Calculator to quantify the financial benefits to present to your employer.

2. Shift Your Working Hours

Travelling off-peak can save significantly:

- Train fares: Off-peak tickets can be 50-60% cheaper

- Fuel costs: Less traffic = better fuel efficiency (up to 30% improvement)

- Time savings: Shorter journey time = less fuel/wear

- Stress reduction: Quieter journeys = better mental health

3. Car Share

Sharing your commute with one colleague halves your costs. With three people, you pay just one-third.

Car Share Savings Calculator

Example: £3,600 ÷ 3 people = £1,200 each (saving £2,400!)

4. Choose a More Fuel-Efficient Vehicle

If you’re buying a car primarily for commuting, fuel efficiency should be a top priority:

| Vehicle Type | Typical MPG | Annual Fuel Cost (10,000 miles) |

|---|---|---|

| Large SUV (petrol) | 30-35 MPG | £1,750 – £2,000 |

| Medium car (petrol) | 45-50 MPG | £1,200 – £1,350 |

| Small car (petrol) | 55-60 MPG | £1,000 – £1,100 |

| Diesel (efficient) | 60-70 MPG | £1,100 – £1,200 |

| Hybrid | 60-80 MPG | £750 – £1,000 |

| Electric (home charging) | 3.5 miles/kWh | £350 – £450 |

Over 5 years, choosing an electric car over a large SUV could save you £7,500 in fuel alone.

5. Use Cashback and Reward Schemes

- Fuel rewards cards: Tesco Clubcard, Nectar points at Sainsbury’s (save 1-2p per litre)

- Credit card rewards: Cards offering 1-3% cashback on fuel purchases

- Season ticket on credit card: Earn points on large annual ticket purchase

- App-based discounts: Apps like Motorway Money offer fuel discounts

6. Optimize Your Route

Sometimes a slightly longer distance route is faster and uses less fuel:

- Motorway cruising at 60mph is more efficient than stop-start urban traffic

- Avoiding hills and traffic lights can improve fuel economy by 10-15%

- Use real-time traffic apps (Waze, Google Maps) to avoid congestion

7. Improve Your Driving Efficiency

Eco-driving techniques can improve fuel economy by 15-25%:

- Accelerate smoothly (aggressive acceleration uses 25% more fuel)

- Maintain steady speeds (use cruise control on motorways)

- Anticipate traffic flow to avoid unnecessary braking

- Remove roof racks when not in use (reduces drag)

- Keep tyres properly inflated (under-inflated tyres reduce MPG by 3%)

- Remove unnecessary weight from your car

- Use air conditioning sparingly (increases fuel use by 5-10%)

8. Switch to an Annual Season Ticket

If you’re buying monthly train tickets, switching to an annual ticket (even with a loan) typically saves 10-15%.

9. Relocate Strategically

This sounds drastic, but consider the numbers:

💼 Example: The Relocation Calculation

Sarah currently lives 25 miles from work and spends £4,500 per year commuting. A flat 5 miles from work costs £150/month more in rent.

Extra rent: £150 × 12 = £1,800 per year

Reduced commute cost: £3,600 saving

Net benefit: £1,800 per year

Plus Sarah saves 90 minutes per day (375 hours/year) and has better work-life balance!

10. Negotiate a Travel Allowance

When negotiating salary (see our Salary Negotiation Calculator), consider asking for a travel allowance or company car if your commute is substantial.

Factoring Commute Costs Into Job Offers

This is critical: when comparing job offers, you must factor in the complete commute cost, not just the salary number.

The Real Salary Comparison Formula

Adjusted Salary Calculation

💼 Example: Comparing Two Job Offers

Job A:

- Salary: £35,000

- Distance: 8 miles (16 miles daily)

- Commute time: 45 minutes return

- Annual commute cost: £2,100

Job B:

- Salary: £38,000

- Distance: 22 miles (44 miles daily)

- Commute time: 75 minutes return

- Annual commute cost: £4,600

Analysis:

| Factor | Job A | Job B |

|---|---|---|

| Gross salary | £35,000 | £38,000 |

| Commute cost | -£2,100 | -£4,600 |

| Net benefit | £32,900 | £33,400 |

| Extra commute time | 176 hours/year | 294 hours/year |

| Real difference | Job B pays only £500 more but costs 118 extra hours | |

When you factor in the time value (£14.47/hour based on Job A salary), those 118 extra hours are worth £1,707—meaning Job A is actually better by £1,207 per year!

Use our comprehensive Job Offer Comparison Tool to make informed decisions when evaluating opportunities.

What to Negotiate

When a job requires significant commuting, consider negotiating:

- Higher base salary to offset commute costs

- Flexible working hours to avoid peak travel times

- Remote working days (even 1-2 days per week makes a huge difference)

- Company car or car allowance

- Season ticket loan for train commuters

- Parking space or parking cost coverage

- Relocation assistance if moving closer is an option

🎯 Key Takeaways

- True cost reality: Your commute likely costs 40-60% more than you think when including hidden expenses like depreciation, insurance, and maintenance

- Fuel calculation: Use the complete formula including MPG, working days, and accurate fuel prices for precise costs

- Public transport: Season tickets typically save 10-15% compared to daily tickets; don’t forget to include parking and connecting transport

- Hidden costs matter: Depreciation (£0.15-0.30/mile), insurance increases, maintenance, and parking can double your apparent commute cost

- Time is money: Factor in the value of your commute time when comparing job offers—59 minutes daily equals 29 working days per year

- Tax relief available: Business mileage (not regular commuting) qualifies for 45p/mile tax relief for first 10,000 miles

- Cost reduction strategies: Remote working, car sharing, off-peak travel, and fuel-efficient vehicles can save £1,000-2,000+ annually

- Job offer evaluation: A £5,000 higher salary with £4,000 more commute costs is really only worth £1,000—always calculate the net benefit

Frequently Asked Questions

The average UK commuter spends between £2,800 – £4,500 per year, depending on distance and method. Car commuters typically spend £3,400 – £4,500, train commuters £3,800 – £6,100 (higher in London), and bus commuters £1,200 – £2,400. However, your individual cost depends on your specific distance, vehicle, and local transport prices.

It depends on distance and circumstances. For short commutes (under 10-12 miles), driving is often cheaper when considering full costs. For longer commutes (15+ miles), trains become more competitive, especially with annual season tickets. However, you must include ALL driving costs (depreciation, insurance, maintenance, parking) not just fuel. Our Commute Cost Calculator can compare both options for your specific situation.

No, you cannot claim tax relief for your regular commute to your permanent workplace. However, if you travel to temporary workplaces, client sites, or multiple locations for work, you can claim mileage allowance at 45p per mile (first 10,000 miles) or 25p per mile thereafter. Use our Mileage Allowance Relief Calculator to see if you qualify.

A 30-mile each-way commute (60 miles daily) typically costs £5,500 – £7,500 per year for car commuters when including all costs (fuel, depreciation, maintenance, insurance, parking). For the same distance by train, expect £6,000 – £9,000 depending on the route and whether you use season tickets. This equals £450-750 per month—a substantial portion of most people’s take-home pay.

Financial advisors recommend keeping commute costs below 10-15% of your gross salary. If you earn £30,000, your commute should ideally cost less than £3,000-4,500 per year. If your commute costs significantly more, consider negotiating remote work days, seeking a travel allowance, or exploring jobs closer to home. Use our Real Salary vs Cost of Living Calculator to assess your situation.

Yes, electric cars have significantly lower running costs—typically £0.03-0.05 per mile for electricity vs. £0.12-0.15 per mile for petrol. For a 10,000-mile annual commute, that’s £300-500 for an EV vs. £1,200-1,500 for petrol—saving £700-1,000 per year. However, EVs have higher purchase prices, so the break-even point depends on your annual mileage and how long you keep the vehicle. High-mileage commuters see the fastest payback.

Calculate the net benefit after commute costs and time value. A £5,000 salary increase might cost £3,000 more in travel and 100+ extra hours of your time annually. Factor both into your decision. Also consider: quality of life, family time, career development opportunities, and long-term prospects. Sometimes a lower-paying job closer to home is financially and personally better. Use our Job Offer Comparison Tool for a comprehensive analysis.

Quick wins: (1) Switch to off-peak travel for cheaper fares and better fuel efficiency, (2) Car share with colleagues to split costs, (3) Buy an annual season ticket instead of monthly (10-15% saving), (4) Improve driving efficiency with eco-driving techniques (15-25% fuel saving), (5) Negotiate one remote work day per week (20% cost reduction), (6) Use fuel reward cards for 1-2p per litre savings, (7) Check tyre pressure monthly (proper inflation saves 3% fuel).

🧮 Calculate Your Exact Commute Cost Now

Stop guessing and get accurate figures for your specific situation. Our free calculator includes fuel, public transport, parking, depreciation, and all hidden costs to give you the complete picture.

Calculate My Commute Cost →🔗 Related UK Employment Tools

- → Job Offer Comparison Tool – Compare total compensation including commute costs

- → Remote Work Savings Calculator – Calculate savings from working from home

- → Mileage Allowance Relief Calculator – Calculate tax relief on business mileage

- → Take-Home Pay Calculator – Calculate net salary after tax and NI

- → Cycle to Work Scheme Calculator – Calculate savings on bikes through salary sacrifice

- → Salary Negotiation Calculator – Negotiate fair compensation including travel allowances

- → View All Free Tools – Complete suite of UK employment calculators