How to Calculate Redundancy Pay in the UK (2026 Complete Guide)

Facing redundancy is stressful enough without worrying whether you’re being paid correctly. If you’re being made redundant in the UK, understanding how to calculate your statutory redundancy pay is essential to ensure you receive what you’re legally entitled to.

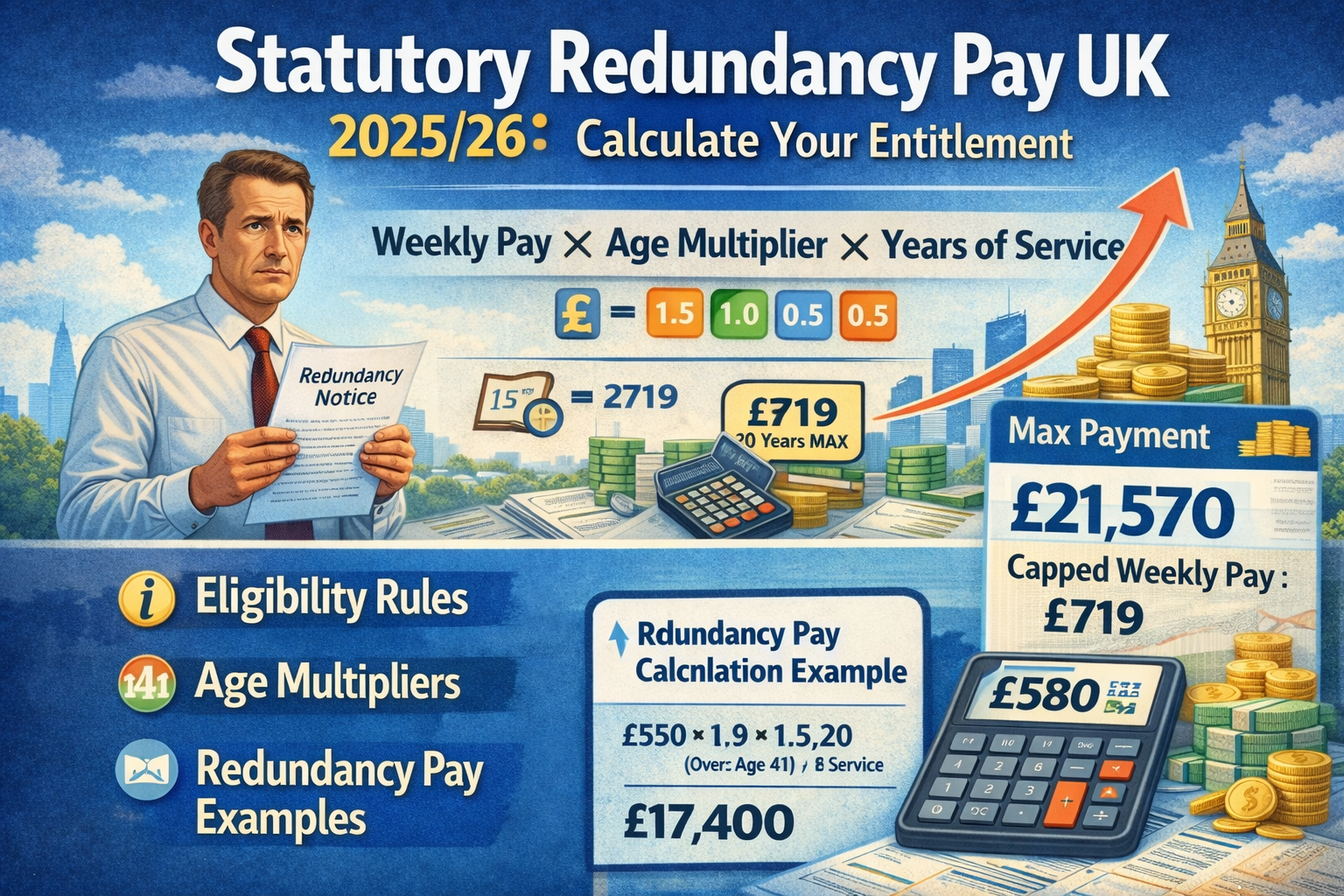

This comprehensive guide explains everything you need to know about redundancy pay calculation in the UK for 2025/26, including eligibility rules, the calculation formula, age-based multipliers, weekly pay caps, and real-world examples to help you work out your exact entitlement.

💡 Quick Answer

Statutory redundancy pay is calculated using: Weekly Pay × Age Multiplier × Years of Service. For 2025/26, weekly pay is capped at £719, and the maximum statutory redundancy payment is £21,570. You need at least 2 years of continuous service to qualify.

What Is Statutory Redundancy Pay?

Statutory redundancy pay is a legal payment you’re entitled to if your employer makes your job role redundant and you’ve worked for them continuously for at least 2 years. It’s a one-off, tax-free payment (up to £30,000) designed to provide financial support while you search for new employment.

Redundancy happens when:

- Your employer closes down the business

- Your workplace closes or relocates

- There’s less work to do (reduced demand for employees)

- Your specific job role is no longer needed

⚠️ Important Note

This guide covers statutory redundancy pay—the minimum you’re entitled to by law. Many employers offer enhanced redundancy packages that are more generous than the statutory minimum. Always check your employment contract and company redundancy policy.

Who Is Eligible for Redundancy Pay?

To qualify for statutory redundancy pay in the UK, you must meet all of these criteria:

| Requirement | Details |

|---|---|

| Employment Status | Employee (not self-employed, contractor, or agency worker) |

| Continuous Service | At least 2 years of continuous employment with the same employer |

| Reason for Dismissal | Genuine redundancy (job no longer exists or is needed) |

| Age | No minimum age (although those under 22 receive a lower multiplier) |

Who Is NOT Eligible?

- Employees with less than 2 years’ continuous service

- Self-employed workers, contractors, and agency temps

- Employees dismissed for misconduct or poor performance

- Those who unreasonably refuse suitable alternative employment offered by their employer

- Workers who resign or retire voluntarily

If you’re uncertain about your employment status, use our Employment Rights Tools to check your eligibility and entitlements.

How to Calculate Your Redundancy Pay: The Formula

The statutory redundancy pay calculation is straightforward once you understand the three key components:

📊 The Official Formula

Redundancy Pay = Weekly Pay × Age Multiplier × Years of Service

Let’s break down each component:

1. Weekly Pay

Your average gross weekly earnings (before tax and NI) calculated over the 12 weeks before the redundancy notice was issued. This includes:

- Basic salary

- Guaranteed overtime

- Regular bonuses and commissions

- Statutory payments (sick pay, maternity pay, etc.)

For 2025/26: Weekly pay is capped at £719 per week for statutory redundancy calculations.

2. Age Multiplier

Your redundancy payment multiplier depends on your age when your notice period ends:

| Your Age | Multiplier (per year of service) |

|---|---|

| Under 22 | 0.5 weeks’ pay |

| 22 to 40 | 1 week’s pay |

| 41 and over | 1.5 weeks’ pay |

3. Years of Service

Only complete years of continuous service count. For example, 7 years and 11 months = 7 years. The maximum is 20 years.

🧮 Calculate Your Redundancy Pay Now

Use our free Redundancy Pay Calculator to work out your exact entitlement based on 2025/26 rates in under 60 seconds.

Calculate My Redundancy Pay →How to Work Out Your Weekly Pay

Your weekly pay is calculated as the average of your gross weekly earnings over the 12 weeks before your redundancy notice. Here’s how to calculate it:

Step-by-Step Calculation

- Identify the 12-week period: Count back 12 weeks from the date your employer issued your redundancy notice (not the date you leave).

- Add up your gross earnings: Include salary, guaranteed overtime, regular bonuses, and commissions earned during those 12 weeks.

- Divide by 12: Total earnings ÷ 12 = average weekly pay.

- Apply the cap: If your weekly pay exceeds £719, your statutory calculation will use £719.

📌 Example: Calculating Weekly Pay

Scenario: Sarah earns £42,000 per year (£3,500 per month). Over the past 12 weeks, she earned a total of £10,500 (including base salary and a quarterly bonus).

Calculation:

£10,500 ÷ 12 weeks = £875 per week

For statutory redundancy: Because £875 exceeds the £719 cap, Sarah’s weekly pay for redundancy purposes is capped at £719.

What’s Included in Weekly Pay?

- ✅ Basic salary or hourly wages

- ✅ Guaranteed overtime (contractual)

- ✅ Regular bonuses and commissions

- ✅ Statutory sick pay, maternity pay, etc.

- ❌ Non-guaranteed overtime

- ❌ Expenses and benefits in kind

- ❌ Irregular or discretionary bonuses

For complex pay structures (e.g., shift work, irregular hours, or commission-based roles), check the GOV.UK redundancy calculator or consult Acas for guidance.

Age-Based Multipliers Explained

The UK redundancy system uses age-based multipliers to reflect the increased difficulty older workers face in finding new employment. Here’s how it works for each age bracket:

Under 22 Years Old (0.5 weeks’ pay per year)

Younger workers typically have shorter service and greater mobility in the job market. For each complete year worked, you receive half a week’s pay.

22 to 40 Years Old (1 week’s pay per year)

This is the standard rate. For each complete year of service, you receive one full week’s pay.

41 Years and Over (1.5 weeks’ pay per year)

Workers aged 41+ receive an enhanced rate of 1.5 weeks’ pay per year of service, recognizing the challenges older workers face when re-entering the job market.

✅ Pro Tip

Your age is calculated at the point your notice period ends, not when the redundancy notice is issued. If you’re turning 41 soon, your employer’s timing could significantly affect your payment.

2025/26 Statutory Caps and Limits

The UK government reviews and updates statutory redundancy limits annually. Here are the current rates for 2025/26 (effective from 6 April 2025):

| Limit Type | 2025/26 Amount |

|---|---|

| Maximum weekly pay | £719 per week |

| Maximum years counted | 20 years |

| Maximum statutory redundancy pay | £21,570 |

| Tax-free amount | First £30,000 |

The maximum payment is calculated as: £719 × 1.5 (highest multiplier) × 20 years = £21,570.

🔍 Important Context

These are minimum statutory entitlements. Many employers offer enhanced redundancy packages that exceed these caps—sometimes paying 2x, 3x, or even more of the statutory amounts. Always check your employment contract and company policy.

Real-World Calculation Examples

Let’s work through detailed examples showing how redundancy pay is calculated for different scenarios:

📝 Example 1: Junior Employee (Age 21, 3 Years Service)

Details:

- Age: 21 years old

- Service: 3 complete years

- Weekly pay: £400 (below the £719 cap)

Calculation:

£400 × 0.5 (under-22 multiplier) × 3 years = £600

Result: Jamie receives £600 statutory redundancy pay.

📝 Example 2: Mid-Career Professional (Age 35, 8 Years Service)

Details:

- Age: 35 years old

- Service: 8 complete years

- Weekly pay: £650 (below the £719 cap)

Calculation:

£650 × 1.0 (age 22-40 multiplier) × 8 years = £5,200

Result: Alex receives £5,200 statutory redundancy pay.

📝 Example 3: Senior Employee (Age 55, 20 Years Service)

Details:

- Age: 55 years old

- Service: 20 complete years (maximum)

- Actual weekly pay: £900 (but capped at £719 for statutory purposes)

Calculation:

£719 × 1.5 (age 41+ multiplier) × 20 years = £21,570

Result: Jordan receives the maximum statutory redundancy pay of £21,570.

📝 Example 4: Mixed Age Brackets (Age 43, Started Age 23)

Details:

- Current age: 43 years old

- Service: 20 years total (started at age 23)

- Weekly pay: £580

Calculation (age brackets split):

- Age 23-40: 18 years × £580 × 1.0 = £10,440

- Age 41-43: 2 years × £580 × 1.5 = £1,740

Total: £10,440 + £1,740 = £12,180

Result: Morgan receives £12,180 statutory redundancy pay.

Use our Redundancy Pay Calculator to instantly work out your exact entitlement based on your circumstances.

The Redundancy Consultation Process

Before making you redundant, your employer must follow a fair consultation process. This is a legal requirement and gives you the opportunity to understand why you’re at risk, explore alternatives, and challenge the decision if necessary.

Individual Consultation (Fewer than 20 Redundancies)

If your employer is making fewer than 20 people redundant, they must:

- Meet with you individually to explain why your role is at risk

- Give you at least 2 working days’ notice before each consultation meeting

- Listen to your views and discuss alternatives (redeployment, job share, voluntary redundancy)

- Confirm decisions and outcomes in writing

Collective Consultation (20+ Redundancies)

If 20 or more employees are being made redundant at one location within 90 days, employers must consult with employee representatives or trade unions:

| Number of Redundancies | Minimum Consultation Period |

|---|---|

| 20-99 employees | At least 30 days before first dismissal |

| 100+ employees | At least 45 days before first dismissal |

⚠️ Unfair Redundancy

If your employer fails to follow a fair process, you may have grounds for an unfair dismissal claim. Use our Unfair Dismissal Compensation Calculator to estimate your potential claim value.

What Should Happen in Consultation Meetings?

- Your employer explains the business reasons for redundancy

- Discussion of why your role is at risk and the selection criteria used

- Exploration of alternatives (other roles, reduced hours, voluntary redundancy)

- Details of redundancy payments, notice period, and final pay

- Support available (outplacement services, CV writing, job search assistance)

You have the right to be accompanied by a colleague or trade union representative to any consultation meetings. For detailed guidance, visit Acas guidance on redundancy.

Notice Period and Final Pay

In addition to redundancy pay, you’re entitled to your statutory or contractual notice period—whichever is longer.

Statutory Minimum Notice Periods

| Length of Service | Minimum Notice |

|---|---|

| 1 month to 2 years | 1 week |

| 2 years to 12 years | 1 week per complete year (e.g., 5 years = 5 weeks) |

| 12 years or more | 12 weeks (maximum) |

Your contract may specify a longer notice period (e.g., 3 months)—if so, the contractual period applies. Use our Notice Period Calculator to check what you’re owed.

Pay in Lieu of Notice (PILON)

Your employer may pay you instead of requiring you to work your notice period. This is called pay in lieu of notice and is subject to tax and National Insurance.

What Your Final Pay Should Include

- ✅ Redundancy payment (tax-free up to £30,000)

- ✅ Notice pay (or PILON)

- ✅ Outstanding holiday pay (accrued but not taken)

- ✅ Salary owed up to termination date

- ✅ Any contractual bonuses or commissions due

Check how much holiday pay you’re owed using our Holiday Entitlement Calculator.

Enhanced Redundancy Packages

Many employers—particularly in the public sector, large corporations, and unionized workplaces—offer enhanced redundancy packages that exceed statutory minimums.

Common Enhanced Terms Include:

- Higher weekly pay caps: Using actual salary instead of the £719 statutory cap

- Increased multipliers: E.g., 2 weeks’ pay per year instead of 1 or 1.5

- Extended service recognition: Counting more than 20 years of service

- Ex-gratia payments: Additional lump sums on top of statutory entitlements

- Additional benefits: Extended health insurance, outplacement support, retraining funding

📌 Example: Enhanced vs Statutory

Employee: Age 50, 15 years’ service, weekly pay £1,200

Statutory calculation:

£719 (capped) × 1.5 × 15 = £16,207.50

Enhanced package (2x multiplier, no cap):

£1,200 × 3.0 × 15 = £54,000

The enhanced package is over 3 times more generous than the statutory minimum.

Always check your employment contract, staff handbook, or collective agreement to see if enhanced terms apply to you.

Tax on Redundancy Payments

Understanding the tax treatment of redundancy payments is crucial for financial planning:

Tax-Free Allowance (First £30,000)

The first £30,000 of your redundancy payment is tax-free and NI-free. This includes:

- Statutory redundancy pay

- Enhanced or ex-gratia payments

- Payments in lieu of notice (if non-contractual)

Taxable Amounts (Above £30,000)

Any redundancy payment above £30,000 is taxed as income in the tax year you receive it. This is added to your other earnings and taxed at your marginal rate:

- Basic rate (20%) if your total income is £12,571 – £50,270

- Higher rate (40%) if your total income is £50,271 – £125,140

- Additional rate (45%) if your total income exceeds £125,140

What Is Always Taxable?

- ❌ Notice pay (taxed at source via PAYE)

- ❌ Holiday pay

- ❌ Outstanding salary or bonuses

- ❌ Payment for working during notice

💡 Tax Planning Tip

If your redundancy pushes you into a higher tax bracket, consider spreading payments across tax years (if your employer agrees) or making pension contributions to reduce taxable income. Use our Take-Home Tax Calculator to model different scenarios.

Your Rights During Redundancy

UK employment law provides several protections during the redundancy process:

1. Fair Selection Process

Your employer must use objective, non-discriminatory selection criteria. Common criteria include:

- Skills, qualifications, and experience

- Performance records and disciplinary history

- Attendance records (excluding protected absences like maternity)

- Length of service (LIFO – “Last In, First Out”)

🚫 Unlawful Selection

It’s illegal to select someone for redundancy based on: age, sex, race, disability, pregnancy, maternity, religion, sexual orientation, or trade union membership. If you believe you’ve been unfairly selected, you may have a discrimination claim.

2. Right to Suitable Alternative Employment

Your employer must offer you any suitable alternative roles that are available within the organization. You have a 4-week trial period to try the new role without losing your right to redundancy pay.

3. Time Off to Find Work

If you have 2+ years’ service, you’re entitled to reasonable paid time off during your notice period to:

- Look for new employment

- Attend job interviews

- Arrange training for future employment

4. Right to Appeal

You can appeal the redundancy decision if you believe:

- The selection process was unfair

- Your employer didn’t explore alternatives properly

- There were procedural failings during consultation

5. Protection for Pregnant Employees and New Parents

Pregnant employees and those on maternity, adoption, or shared parental leave have enhanced protection. They must be offered any suitable alternative roles before other at-risk employees. Learn more about maternity rights and pay.

6. Right to Claim Unfair Dismissal

Even in genuine redundancy situations, you can claim unfair dismissal if your employer:

- Failed to follow a fair consultation process

- Used discriminatory selection criteria

- Didn’t consider suitable alternatives

- Failed to offer you a 4-week trial period in a new role

Calculate your potential compensation with our Unfair Dismissal Calculator.

Common Calculation Mistakes to Avoid

Here are the most frequent errors people make when calculating redundancy pay:

❌ Mistake 1: Counting Incomplete Years

Wrong: “I’ve worked here 7 years and 10 months, so I’ll use 8 years.”

Right: Only complete years count—use 7 years, not 8.

❌ Mistake 2: Using Net Pay Instead of Gross

Wrong: Using take-home pay after tax and NI.

Right: Always use gross (before tax) weekly earnings for the calculation.

❌ Mistake 3: Forgetting the Weekly Pay Cap

Wrong: “I earn £1,000 per week, so I’ll use that.”

Right: Statutory calculations cap weekly pay at £719 (2025/26).

❌ Mistake 4: Not Checking for Enhanced Terms

Wrong: Assuming statutory minimum is all you’ll receive.

Right: Always check your contract and company policy—you may be entitled to more.

❌ Mistake 5: Miscalculating Age Brackets

Wrong: Using your current age for all service years.

Right: Apply the correct multiplier for each age bracket (see Example 4 above).

❌ Mistake 6: Confusing Redundancy Pay with Notice Pay

Wrong: Thinking redundancy pay includes notice pay.

Right: These are separate entitlements—you should receive both.

🎯 Avoid Calculation Errors

Use our official calculator to ensure 100% accuracy based on GOV.UK formulas and 2025/26 rates.

Calculate Accurately Now →Frequently Asked Questions

Can I negotiate my redundancy payment?

Yes. While you can’t negotiate statutory redundancy pay (it’s fixed by law), you can often negotiate an enhanced package or additional benefits like extended notice, outplacement support, or a better reference. Employers may be open to negotiation to avoid tribunal claims or to maintain goodwill.

What if my employer can’t afford to pay redundancy?

If your employer is insolvent or enters administration, you can claim redundancy pay from the Redundancy Payments Service (part of the Insolvency Service). They will pay up to the statutory maximum (currently £21,570 for 2025/26) plus arrears of wages, notice pay, and holiday pay (subject to limits).

Do I get redundancy pay if I find another job during my notice period?

Yes. You’re still entitled to redundancy pay even if you secure new employment before your notice period ends. You can also leave early to start your new job (with your employer’s agreement) without losing your redundancy pay, provided you give proper notice.

Is redundancy pay affected by taking a voluntary redundancy?

No. Voluntary redundancy packages are often more generous than compulsory redundancy. You’ll receive at least the statutory minimum, and employers typically offer enhanced terms to encourage volunteers (e.g., extra months’ pay, extended benefits).

Can I be made redundant while on sick leave or maternity leave?

Yes, but you have additional protections. Pregnant employees and those on maternity leave must be offered suitable alternative roles first, ahead of other at-risk employees. Selecting someone for redundancy because they’re pregnant or on maternity leave is discrimination. Check your rights with Acas or a specialist employment solicitor.

How long do I have to claim unpaid redundancy pay?

You must bring a claim to an Employment Tribunal within 3 months minus 1 day of your employment ending. If your employer is insolvent, you can claim from the Redundancy Payments Service within 6 months of your employment ending.

Does redundancy pay affect my benefits (Universal Credit, Jobseeker’s Allowance)?

Yes. Redundancy payments count as capital for means-tested benefits. If your total capital (including redundancy pay, savings, and investments) exceeds £16,000, you won’t qualify for Universal Credit or income-based Jobseeker’s Allowance. Check your entitlement with our Universal Credit Calculator.

Key Takeaways

📌 Summary: Calculating Redundancy Pay in the UK

- Eligibility: You need at least 2 years of continuous service to qualify for statutory redundancy pay.

- Formula: Redundancy Pay = Weekly Pay × Age Multiplier × Years of Service (max 20 years).

- 2025/26 caps: Weekly pay capped at £719; maximum statutory redundancy is £21,570.

- Age multipliers: Under 22 (0.5x), 22-40 (1.0x), 41+ (1.5x) per year of service.

- Tax-free: First £30,000 of redundancy payments is tax-free and NI-free.

- Enhanced packages: Check your contract—many employers pay significantly more than the statutory minimum.

- Your rights: Fair consultation, suitable alternatives, time off to find work, and the right to appeal.

- Get help: Use our free Redundancy Pay Calculator for instant, accurate calculations.

Related Tools and Resources

Make the most of our suite of employment rights and financial planning tools:

- Redundancy Pay Calculator UK – Calculate your exact entitlement in seconds

- Unfair Dismissal Compensation Calculator – Estimate tribunal award if your redundancy is unfair

- Notice Period Calculator – Check how much notice you’re owed

- Holiday Entitlement Calculator – Work out accrued but untaken holiday pay

- Take-Home Tax Calculator – Model tax on redundancy payments over £30,000

- Universal Credit Calculator – Check benefit entitlement after redundancy

- Sick Pay Calculator – For those made redundant while on sick leave

- Job Offer Comparison Tool – Compare new job offers against your redundancy package

- View All 28+ Employment Tools – Comprehensive toolkit for UK workers

💼 Need Help Understanding Your Redundancy?

Facing redundancy is challenging, but knowing your rights and entitlements gives you the power to ensure fair treatment. Calculate your redundancy pay now and explore all your options.

Use Our Free Calculator →Official Resources and Further Reading

For official guidance and legal advice:

- GOV.UK – Redundancy: Your Rights (official government guidance)

- GOV.UK Redundancy Calculator (official calculator)

- Acas – Redundancy (free, impartial advice and guidance)

- Citizens Advice – Redundancy (practical help and next steps)

- The Insolvency Service (claim redundancy pay if employer is insolvent)

Disclaimer: This guide provides general information about statutory redundancy pay in the UK and should not be considered legal or financial advice. Individual circumstances vary, and employment contracts may provide enhanced terms. For specific advice about your situation, consult Acas, Citizens Advice, or a qualified employment solicitor.

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

- FastJobs UK Team

Related Articles

-

How to Write a CV for Job in the UK: A Step by Step Guide (2026)January 9, 2026