How to Calculate Your Holiday Entitlement in the UK (2026 Guide)

Did you know? Many UK workers don’t claim their full holiday entitlement simply because they don’t know how to calculate it properly. Whether you work full-time, part-time, or irregular hours, understanding your statutory annual leave rights is crucial for maintaining work life balance and ensuring you’re not missing out on paid time off you’re legally entitled to.

What is Statutory Holiday Entitlement in the UK?

Let me start with the basics. In the UK, almost every worker is legally entitled to 5.6 weeks of paid holiday per year. This is your statutory minimum—your baseline right that no employer can take away from you.

Now, before you get your calculator out, let’s break down what this actually means in practice.

The Legal Foundation

This entitlement comes from the Working Time Regulations 1998, which implemented European Union law into UK legislation. Even after Brexit, these rights remain protected under UK law so you can rest assured your holiday entitlement hasn’t changed.

The 5.6 weeks figure wasn’t picked randomly. Here’s how Parliament arrived at it:

- 4 weeks come from the EU Working Time Directive

- 1.6 weeks (8 days) were added by the UK to cover the 8 typical bank holidays

- Total: 5.6 weeks = 28 days for someone working 5 days a week

Your employer can offer MORE than 5.6 weeks (and many do), but they cannot offer less. If your contract says anything below the statutory minimum, that clause is automatically void—the legal minimum still applies.

Who Qualifies?

Here’s the refreshing part: eligibility is remarkably straightforward. You qualify for statutory holiday entitlement if you’re classed as a “worker” under UK law. This includes:

- Full-time employees

- Part-time employees

- Workers on zero-hours contracts

- Agency workers

- Casual workers

- Workers on probation periods

The only people who don’t qualify are genuinely self employed individuals who work for themselves, not for an employer. If you’re in any doubt, ask yourself: “Do I have a contract with someone to personally do work for them?” If yes, you’re almost certainly entitled to holiday pay.

💡 Real-World Context

Sarah works as a teaching assistant on a term time only contract. Her friend James works irregular shifts at a warehouse. Both were initially told they weren’t entitled to holiday pay because they weren’t “proper employees.”

They were both wrong. Term-time workers and irregular hours workers ARE entitled to paid holiday—they just need to calculate it differently (more on this later).

Basic Holiday Calculation for Full-Time Workers

If you work a standard 5-day week (Monday to Friday), the calculation is beautifully simple:

Standard Full-Time Calculation

This is your statutory minimum for a full year of work

Twenty-eight days. That’s 4 weeks plus 8 extra days—roughly equivalent to your standard bank holidays.

What If You Work 6 Days a Week?

Now here’s where it gets interesting. The 5.6 weeks applies regardless of how many days you work. So if you work 6 days a week:

Six-Day Week Calculation

Round up to 34 days per year

Notice how this works: the person working 6 days gets more holiday days, but the same amount of holiday weeks (5.6 weeks). This ensures fairness regardless of your working pattern.

💼 Example: Marcus’s Holiday Calculation

Marcus works Monday to Saturday at a retail shop—6 days a week, every week.

His holiday entitlement:

6 days × 5.6 weeks = 33.6 days (round to 34 days)

This means Marcus can take approximately 34 days off with pay each year. If he takes a full week off, that uses 6 days of his entitlement (because he normally works 6 days).

Hours vs. Days: Does It Matter?

Some employers calculate holiday in hours rather than days. This is perfectly legal and often makes sense for shift workers. The principle remains the same—you multiply your normal working pattern by 5.6.

| Working Pattern | Hours per Week | Holiday Entitlement (Hours) |

|---|---|---|

| Full-time (37.5 hrs/week) | 37.5 | 37.5 × 5.6 = 210 hours |

| Full-time (40 hrs/week) | 40 | 40 × 5.6 = 224 hours |

| Part-time (20 hrs/week) | 20 | 20 × 5.6 = 112 hours |

Part-Time Workers: Pro-Rata Calculations

This is where many workers—and unfortunately, many employers get confused. Part time workers have exactly the same right to paid holiday as full-timers, just calculated proportionally to their hours.

The Golden Rule

The calculation follows the same principle: multiply your working pattern by 5.6. Let me show you how this plays out in practice.

💼 Example: Lisa’s Part-Time Holiday

Lisa works 3 days per week (Wednesday, Thursday, Friday) every week.

Her holiday entitlement:

3 days × 5.6 weeks = 16.8 days (round to 17 days)

What this means:

Lisa gets 17 days of paid leave per year. When she takes a day off, it counts as one day from her entitlement—just like a full-time colleague taking one day off.

Why Part-Time Workers Sometimes Feel Short-Changed (But Aren’t)

Here’s a common source of frustration I’ve seen: Lisa (working 3 days) gets 17 days holiday, while her colleague Tom (working 5 days) gets 28 days. “That’s not fair!” Lisa might think.

But actually, it is fair. Here’s why:

- Lisa works 3 days: 17 days ÷ 3 = 5.6 weeks off

- Tom works 5 days: 28 days ÷ 5 = 5.6 weeks off

They both get exactly the same amount of time off—5.6 weeks. The number of days differs because they work different patterns, but the amount of weeks is identical.

If you’re part-time and your employer gives full-timers extra holiday beyond the statutory 28 days (say, 30 days), you’re entitled to the same proportion of extra days.

Example: If full-timers get 30 days instead of 28, that’s a 7% increase. Part-time workers should get the same 7% increase on top of their statutory entitlement.

Calculating for Irregular Part-Time Patterns

What if your part-time hours vary? Perhaps you work 15 hours some weeks, 22 hours other weeks? In this case, it’s better to calculate in hours:

Irregular Part-Time Calculation

1. Calculate your average weekly hours over the past 52 weeks (or the number of weeks you’ve worked if less)

2. Multiply by 5.6

Bank Holidays: The Great Confusion

This is hands-down the most misunderstood aspect of UK holiday entitlement. Let me clear this up once and for all.

The Legal Position

There is NO automatic legal right to take bank holidays off work, and there’s no law saying bank holidays must be paid.

Surprised? Most people are. Here’s what the law actually says:

- You’re entitled to 5.6 weeks of paid holiday per year

- Your employer decides when you can take it (within reason)

- Your employer can require you to work on bank holidays

- Your employer can require you to take holiday on bank holidays

“I get 28 days holiday PLUS the 8 bank holidays.”

Reality: Unless your contract explicitly states this, most employers include bank holidays within your 28 days, not on top of them.

Two Common Scenarios

Scenario A: Bank Holidays Included (Most Common)

Your contract says you get “28 days including bank holidays.” This means:

- You get 28 days total

- 8 of those days are typically bank holidays

- 20 days left for you to book when you choose

- If your employer makes you work a bank holiday, you lose one of your 28 days unless they give it back to you

Scenario B: Bank Holidays Separate (Less Common, Better for You)

Your contract says “28 days plus bank holidays.” This means:

- You get 28 days to book whenever you want

- PLUS 8 bank holidays (or equivalent) off

- Total: 36 days off per year

Always check your contract to see which arrangement you have. The key phrase to look for is whether bank holidays are “inclusive” or “in addition to” your annual leave.

Working Bank Holidays: What Are Your Rights?

Many sectors require staff to work on bank holidays—retail, hospitality, healthcare, emergency services, and others. If you work a bank holiday:

| Situation | Your Rights |

|---|---|

| Required to work bank holiday | Employer must give you a day off elsewhere OR count it as holiday used (if BH included in your 28 days) |

| Extra pay for bank holidays? | No automatic legal right—depends on your contract |

| Time off in lieu (TOIL) | Common practice but not legally required unless in your contract |

💼 Example: Priya’s Retail Job

Priya works in a shop that’s open on bank holidays. Her contract states “28 days including bank holidays.”

The shop is open on the August bank holiday, and Priya’s rota says she’s working.

Option 1: Priya works the bank holiday, and it doesn’t count against her 28 days (she gets a day back somewhere)

Option 2: The employer counts it as one of her 28 days used (meaning she’s effectively worked a day of her holiday)

Fair approach: Most reasonable employers use Option 1 or offer extra pay for bank holiday working.

Irregular Hours and Zero-Hours Contracts

From April 2024, the rules for calculating holiday for irregular hours workers changed significantly. If you work irregular hours or you’re on a zero-hours contract, pay attention—this affects you.

The New Accrual Method (April 2024 Onwards)

Previously, irregular hours workers struggled to calculate holiday because their hours changed so much. The government introduced a simpler system:

You accrue holiday at a rate of 12.07% of the hours you actually work.

Where does 12.07% come from? It’s a mathematical way of ensuring you get 5.6 weeks holiday:

The 12.07% Explained

(46.4 weeks = 52 weeks minus 5.6 weeks holiday)

How It Works in Practice

💼 Example: Jamie’s Zero-Hours Contract

Jamie works at a cinema on a zero-hours contract. His hours vary wildly:

- Week 1: Works 15 hours

- Week 2: Works 8 hours

- Week 3: Works 22 hours

- Week 4: Works 0 hours (not needed)

Holiday accrual:

Total hours worked = 45 hours

Holiday accrued = 45 × 12.07% = 5.43 hours of paid holiday

Jamie can now take 5.43 hours of paid time off (paid at his average hourly rate).

Holiday Pay Calculation

When irregular hours workers take holiday, they should be paid their average hourly rate over the past 52 weeks (or the number of weeks they’ve worked if less than 52).

This ensures you’re not financially worse off for taking holiday, even though your hours and pay vary.

Before April 2024, some irregular workers were paid “rolled-up holiday pay” (holiday pay added to each hour’s wage). This is now illegal for most workers. Holiday must be paid when you actually take time off.

How Holiday Accrues During the Year

You don’t get your full holiday entitlement on day one of your job. Holiday builds up (accrues) throughout the year.

Standard Accrual Rate

If you work consistent hours, holiday typically accrues like this:

Monthly Accrual Calculation

Example: 28 days ÷ 12 = 2.33 days per month

So if you’re 3 months into a new job, you’ve accrued approximately 7 days of holiday (2.33 × 3 = 7 days).

Your First Year

During your first year of employment, you might not have enough accrued leave to take a week off. Your employer can:

- Let you “borrow” holiday you haven’t yet accrued (you’d owe it back if you left)

- Only let you take the holiday you’ve actually built up

- Give you your full entitlement upfront (generous but rare)

Check your contract or ask HR about their policy.

Leave Year vs. Calendar Year

Your “holiday year” might not run January to December. Common arrangements include:

- Calendar year: 1 January – 31 December

- Tax year: 6 April – 5 April

- Company year: Often from company founding date or financial year

- Your start date: Some employers run your holiday year from when you joined

This matters because your 5.6 weeks applies to each holiday year, not each calendar year necessarily.

🧮 Calculate Your Exact Holiday Entitlement

Stop guessing and get the accurate figure you’re legally entitled to. Our free calculator handles all working patterns including part-time, irregular hours, and zero-hours contracts.

Use Free Holiday Calculator →What Happens When You Leave Your Job?

Whether you resign, get made redundant, or your contract ends, you need to understand how holiday works when you leave a job. Get this wrong and you could lose out on money you’re owed.

Unused Holiday: You Get Paid

If you have unused holiday when you leave, your employer must pay you for it. This is a legal requirement—they can’t just forfeit your accrued leave.

The calculation is:

Unused Holiday Payment

1. Work out how many days you’ve accrued up to your leaving date

2. Subtract any days you’ve already taken

3. The remainder should be paid at your normal daily rate

💼 Example: Tom Leaves His Job

Tom works 5 days a week with 28 days annual leave. His holiday year runs January-December, and he’s leaving on 30 June (exactly halfway through the year).

Holiday accrued by June 30: 28 days ÷ 2 = 14 days

Holiday taken: 8 days

Unused holiday owed: 14 – 8 = 6 days

Tom’s final payslip should include payment for these 6 unused days.

Taken Too Much Holiday: You Might Owe Money

Here’s the flip side: if you’ve taken more holiday than you’d accrued by your leaving date, your employer can deduct the “overpaid” holiday from your final pay.

But they can only do this if:

- Your contract explicitly allows it, AND

- They gave you written notice before you left

If neither of these conditions is met, they generally can’t chase you for the money.

Notice Periods and Holiday

A common question: “Can my employer make me take my remaining holiday during my notice period?”

Short answer: Yes, usually.

Your employer can require you to take holiday during your notice period, as long as they give you notice (typically twice as many days’ notice as the holiday you’re being told to take—e.g., 4 days’ notice for 2 days’ holiday).

Some employers try to use “garden leave” (where you stay away from work but are still employed) as holiday. These are different things. Garden leave is paid suspension—it shouldn’t use up your holiday entitlement unless explicitly stated.

Common Mistakes Employers Make (And How to Spot Them)

Unfortunately, not all employers get holiday entitlement right. Here are the most common errors I’ve seen, and what you should do if you spot them.

1. “You Don’t Get Holiday During Your Probation”

This is wrong. You start accruing holiday from day one of employment, even during probation. Some employers might restrict when you can take holiday during probation, but you’re still building it up.

2. “Part-Timers Only Get X Days”

If the “X days” doesn’t work out to 5.6 weeks of your working pattern, this is likely discriminatory. Part-time workers must be treated proportionally to full-time workers.

Example of discrimination: Full-timers get 28 days, but part-timers (working 3 days/week) are given 10 days. The part-timer should get 16.8 days (3 × 5.6 weeks).

3. “Use It or Lose It” Policies

While employers can set your holiday year and may require you to take holiday at certain times, they cannot:

- Refuse to let you take your statutory 5.6 weeks

- Automatically forfeit unused statutory holiday at year-end (though they can for additional contractual holiday beyond 5.6 weeks)

- Pay you in lieu of taking holiday (except when you leave)

1. Check your contract and payslips carefully

2. Calculate what you should be getting using the 5.6 weeks rule

3. If there’s a discrepancy, raise it with HR or your manager in writing

4. If not resolved, contact ACAS (Advisory, Conciliation and Arbitration Service) for free advice

4. Incorrect Holiday Pay Rates

Your holiday pay should be at your normal rate, including:

- Regular overtime (if it’s compulsory or you do it regularly)

- Regular commission

- Regular bonuses linked to performance

Many employers forget to include these, paying only basic salary for holiday. This is unlawful following several employment tribunal cases.

Your Rights if Holiday is Denied

Your employer must allow you to take your statutory 5.6 weeks each year. If they’re preventing this, here’s what you should know.

Can Employers Refuse Holiday Requests?

Yes, employers can refuse specific holiday requests, but they must:

- Give you notice of refusal (typically twice the length of the holiday you requested)

- Have a reasonable business reason

- Still allow you to take your full entitlement at some point in the year

Employers cannot simply block all holiday or prevent you from taking your statutory 5.6 weeks annually.

Steps to Take

If you’re being denied holiday:

Step 1: Request in Writing

Email your holiday request and keep a copy. This creates a paper trail.

Step 2: Escalate Internally

If your manager refuses, escalate to HR or senior management, explaining that you’re concerned about losing your statutory entitlement.

Step 3: Contact ACAS

ACAS offers free, impartial advice. They can help mediate between you and your employer.

Step 4: Consider Employment Tribunal

As a last resort, you can bring a claim to an employment tribunal. You usually must contact ACAS first for “early conciliation” before doing this.

Claims about holiday pay must usually be brought within 3 months of when the issue happened. Don’t wait too long to raise concerns.

🎯 Key Takeaways

- Statutory minimum: 5.6 weeks (28 days for 5-day week workers) regardless of your contract length or work pattern

- Calculation principle: Your working days/hours per week × 5.6 = your entitlement

- Bank holidays: Not automatically separate from your 28 days—check your contract

- Part-time workers: Get the same proportion of holiday as full-timers (pro-rata)

- Irregular/zero-hours: Accrue holiday at 12.07% of hours worked from April 2024

- Leaving jobs: Unused accrued holiday must be paid; over-taken holiday may be deducted

- Common errors: Watch for employers denying probation holiday, incorrect part-time calculations, or excluding overtime from holiday pay

Frequently Asked Questions

Generally, no—unless your contract says otherwise or your employer agrees. However, there are exceptions if you were unable to take holiday due to sickness or maternity leave. Since COVID-19, some flexibility has been added allowing carry-over if you couldn’t take leave due to pandemic restrictions.

No. If you’re off sick, you continue to accrue holiday as normal. If you were already on holiday when you became ill, you can treat those days as sick leave instead (if you provide a medical certificate) and save your holiday for later.

Only when you leave your job. While you’re employed, your employer must let you take your 5.6 weeks as actual time off—they can’t just pay you to keep working. (Note: This is different for genuine self-employed contractors.)

If you only work weekends, you still get 5.6 weeks holiday, just calculated on your working pattern. Since bank holidays are almost always Monday-Friday, weekend-only workers don’t directly benefit from them—but this is already factored into the 5.6 weeks calculation which is designed to be fair across all working patterns.

It depends. If you work 5 days a week, the legal minimum is 28 days, so 20 days would be unlawful. However, if your contract says “20 days plus bank holidays,” that’s 28 days total—which meets the minimum. Always check whether bank holidays are included or additional.

Yes, to an extent. Employers can require you to take holiday at specific times (e.g., Christmas shutdown) or save holiday for specific periods. They must give you notice (usually twice the length of the holiday). However, they still must allow you to take your full 5.6 weeks entitlement over the year.

📊 Calculate Your Holiday Entitlement Now

Get an accurate calculation for your exact working pattern. Our free calculator is updated for 2025/26 regulations and handles any working arrangement including irregular hours and zero-hours contracts.

Calculate My Holiday →🔗 Related UK Employment Tools

- → Notice Period Calculator – Calculate statutory minimum notice

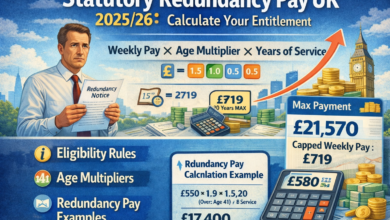

- → Redundancy Pay Calculator – Know your entitlement if made redundant

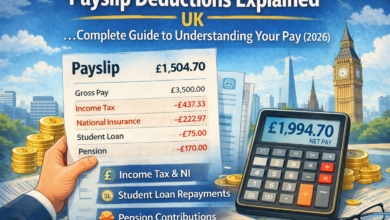

- → Take-Home Pay Calculator – Calculate net salary after tax

- → View All Free Tools – Complete suite of UK employment calculators