Payslip Deductions Explained UK: Complete Guide to Understanding Your Pay (2026)

📋 What Is a Payslip and Why Does It Matter?

By law, every UK employer must provide employees and workers with a payslip on or before payday. This isn’t just a formality—your payslip is a legal document that serves as proof of your earnings, tax payments, and pension contributions.

📌 Legal Requirements

Under the Employment Rights Act 1996, your payslip must show:

- Your gross pay (earnings before deductions)

- Your net pay (take-home after deductions)

- All variable deductions (tax, National Insurance, student loans)

- The number of hours worked (if your pay varies)

Fixed deductions (like season ticket loans) can be explained on a separate annual statement rather than itemised each month.

You can receive your payslip in printed or electronic format—both are equally valid. Employers typically provide payslips monthly, but some pay weekly or fortnightly.

Who Gets a Payslip?

You’re entitled to a payslip if you’re classified as an employee or worker. However, you won’t receive one if you’re:

- A self-employed contractor or freelancer

- In the police service

- A merchant seaman

- Working in share fishing as master or crew

Not sure of your employment status? Check the gov.uk employment status checker.

🧮 Calculate Your Exact Take-Home Pay

Want to know exactly how much you’ll receive after all deductions? Use our free calculator.

Calculate Your Take-Home Pay →💷 Understanding Statutory Deductions (The Big Four)

Statutory deductions are mandatory payments deducted by law. You can’t opt out of these, and every UK employer must calculate and deduct them correctly. Let’s break down each one.

1. Income Tax (PAYE)

PAYE (Pay As You Earn) is the system HMRC uses to collect income tax directly from your wages. The amount you pay depends on your earnings and your tax code.

2025/26 Income Tax Rates (England, Wales, Northern Ireland)

| Tax Band | Income Range | Tax Rate | Annual Tax |

|---|---|---|---|

| Personal Allowance | £0 – £12,570 | 0% | £0 |

| Basic Rate | £12,571 – £50,270 | 20% | £7,540 |

| Higher Rate | £50,271 – £125,140 | 40% | Up to £37,488 |

| Additional Rate | Over £125,140 | 45% | Variable |

⚠️ Scotland Has Different Tax Bands

Scottish residents pay tax using a different scale:

- Starter rate: 19% (£12,571–£15,397)

- Basic rate: 20% (£15,398–£27,491)

- Intermediate rate: 21% (£27,492–£43,662)

- Higher rate: 42% (£43,663–£75,000)

- Advanced rate: 45% (£75,001–£125,140)

- Top rate: 48% (over £125,140)

Understanding Your Tax Code

Your tax code tells your employer how much tax to deduct. The most common code for 2025/26 is 1257L, which means:

- 1257 = Your Personal Allowance (£12,570) divided by 10

- L = You’re entitled to the standard Personal Allowance

📌 Common Tax Code Letters

- L – Standard Personal Allowance

- M – Marriage Allowance transferred to you

- N – You’ve transferred Marriage Allowance to your partner

- T – Your code includes other calculations

- BR – All income taxed at basic rate (20%)

- D0 – All income taxed at higher rate (40%)

- D1 – All income taxed at additional rate (45%)

- NT – No tax to pay

- S – Scottish tax rates apply

- C – Welsh tax rates apply

Wrong tax code? Use our Tax Code Checker to verify and fix it.

Example Income Tax Calculation

📊 Sarah earns £35,000 per year

Step 1: Subtract Personal Allowance

£35,000 – £12,570 = £22,430 (taxable income)

Step 2: Calculate tax (Basic Rate 20%)

£22,430 × 20% = £4,486 per year

Step 3: Monthly deduction

£4,486 ÷ 12 = £373.83/month

2. National Insurance (NI)

National Insurance contributions fund state benefits including the State Pension, NHS, and unemployment support. Employees pay Class 1 National Insurance through PAYE.

2025/26 National Insurance Rates (Employees)

| Annual Earnings | Monthly Equivalent | Weekly Equivalent | NI Rate |

|---|---|---|---|

| £0 – £12,570 | £0 – £1,047.50 | £0 – £242 | 0% |

| £12,571 – £50,270 | £1,047.51 – £4,189.17 | £242.01 – £967 | 8% |

| Over £50,270 | Over £4,189.17 | Over £967 | 2% |

⚠️ Important: NI Threshold = Tax Threshold in 2025/26

Since April 2022, the NI threshold has been aligned with the Income Tax Personal Allowance at £12,570. This means you start paying both tax and NI at the same income level.

Example National Insurance Calculation

📊 Tom earns £45,000 per year

Step 1: Identify NI bands

£12,571 – £45,000 = £32,429 taxable for NI at 8%

Step 2: Calculate NI

£32,429 × 8% = £2,594.32 per year

Step 3: Monthly deduction

£2,594.32 ÷ 12 = £216.19/month

💡 Good News: You Stop Paying NI at State Pension Age

Once you reach State Pension age, you no longer pay National Insurance—even if you continue working. However, you still pay Income Tax on earnings above the Personal Allowance.

3. Student Loan Repayments

If you took out a student loan, repayments are automatically deducted through PAYE once your income exceeds the repayment threshold for your plan type.

2026/27 Student Loan Thresholds & Rates

| Plan Type | Annual Threshold | Monthly Threshold | Repayment Rate | Who Has This Plan? |

|---|---|---|---|---|

| Plan 1 | £26,900 | £2,241 | 9% | English/Welsh students before Sept 2012; Scottish/NI students |

| Plan 2 | £29,385 | £2,448 | 9% | English/Welsh students Sept 2012 onwards |

| Plan 4 | £33,795 | £2,816 | 9% | Scottish students |

| Plan 5 | £25,000 | £2,083 | 9% | Students starting from Aug 2023 onwards |

| Postgraduate (Plan 3) | £21,000 | £1,750 | 6% | Postgraduate loans (Masters/Doctoral) |

🆕 Plan 5 Launched in April 2026

Plan 5 is the newest repayment structure for students who started courses from August 2023. Key features:

- Lower threshold (£25,000) means repayments start sooner

- Extended repayment period (40 years instead of 30)

- Lower interest rates capped at RPI only

Example Student Loan Calculation

📊 Emma earns £32,000 on Plan 2

Step 1: Calculate income above threshold

£32,000 – £29,385 = £2,615

Step 2: Calculate 9% repayment

£2,615 × 9% = £235.35 per year

Step 3: Monthly deduction

£235.35 ÷ 12 = £19.61/month

💡 Multiple Student Loans?

If you have both an undergraduate loan (Plan 1, 2, 4, or 5) and a postgraduate loan (Plan 3), you’ll pay deductions for both simultaneously—up to 15% combined (9% + 6%).

Learn more in our detailed guide: Student Loan Repayment UK 2026

🧮 Calculate Your Student Loan Repayments

Find out exactly how much you’ll repay each month based on your salary and loan plan.

Calculate Student Loan Repayments →4. Pension Contributions (Workplace Pensions)

Since 2012, UK employers have been required to automatically enrol eligible employees into a workplace pension scheme. Pension contributions are deducted from your gross salary before tax, giving you immediate tax relief.

2025/26 Minimum Pension Contribution Rates

| Contribution Type | Minimum Rate | Who Pays |

|---|---|---|

| Total Minimum | 8% | Combined employee + employer |

| Employer Minimum | 3% | Your employer |

| Employee Minimum | 5% | You (deducted from salary) |

✅ Tax Relief on Pension Contributions

Pension contributions are deducted before Income Tax, which means you get automatic tax relief:

- Basic rate taxpayer (20%): Every £1 you contribute only costs you £0.80

- Higher rate taxpayer (40%): Every £1 you contribute only costs you £0.60

- Additional rate taxpayer (45%): Every £1 you contribute only costs you £0.55

Example Pension Contribution Calculation

📊 David earns £30,000, contributes 5% to pension

Step 1: Calculate qualifying earnings

Qualifying earnings = £30,000 (entire salary used in this example)

Step 2: Calculate 5% employee contribution

£30,000 × 5% = £1,500 per year

Step 3: Monthly deduction

£1,500 ÷ 12 = £125/month

Bonus: David’s employer contributes 3% (£900/year) on top!

💡 Want to Boost Your Pension?

Many employers allow you to make Additional Voluntary Contributions (AVCs) above the minimum. This appears as a separate deduction (often labelled “AVC” or “Pension+”) on your payslip and gives you extra tax relief.

Use our Pension Contribution Calculator to see how increasing contributions affects your take-home pay and retirement pot.

📝 Common Payslip Abbreviations Explained

Payslips are full of confusing codes and abbreviations. Here’s what they actually mean:

| Abbreviation | Full Term | What It Means |

|---|---|---|

| PAYE | Pay As You Earn | Income tax deducted from your salary |

| NI / NIC | National Insurance Contributions | National Insurance deductions |

| NI Number | National Insurance Number | Your unique identifier (format: AB 12 34 56 C) |

| Gross Pay | – | Total earnings before any deductions |

| Net Pay | – | Take-home pay after all deductions |

| Taxable Pay | – | Income subject to tax (gross minus pension contributions) |

| YTD | Year To Date | Total amount from April 6th to current pay date |

| SL / SLR | Student Loan Repayment | Student loan deduction (SL1, SL2, SL4, SL5 for plan types) |

| PGL | Postgraduate Loan | Postgraduate (Masters/Doctoral) loan repayment |

| Pension / EE Pension | Employee Pension | Your pension contribution |

| ER Pension | Employer Pension | Employer’s pension contribution (doesn’t reduce your pay) |

| AVC | Additional Voluntary Contribution | Extra pension contributions you’ve chosen to make |

| SSP | Statutory Sick Pay | Government sick pay (£116.75/week in 2025/26) |

| SMP | Statutory Maternity Pay | Maternity pay from your employer |

| SPP | Statutory Paternity Pay | Paternity pay entitlement |

| SAP | Statutory Adoption Pay | Adoption pay entitlement |

| Attachment | Attachment of Earnings | Court-ordered deductions (e.g., child maintenance, debt repayment) |

| Tax Code | – | Code telling employer how much tax to deduct (e.g., 1257L) |

| Week 1 / Month 1 | – | Emergency tax code—only considers current pay period |

🔍 Voluntary & Other Deductions

Beyond statutory deductions, you might see additional items deducted from your pay. These fall into two categories:

Voluntary Deductions (You Agreed to These)

- Additional Voluntary Contributions (AVCs) – Extra pension contributions

- Salary Sacrifice Schemes – Childcare vouchers, cycle-to-work, electric car schemes

- Trade Union Subscriptions – Union membership fees

- Charitable Giving – Payroll Giving / Give As You Earn (GAYE)

- Company Loans – Repayment of season ticket loans, advance salary, relocation loans

- Private Medical Insurance – Company health scheme contributions

- Life Assurance – Additional life insurance premiums

✅ Tax Benefits of Salary Sacrifice

When you participate in a salary sacrifice scheme, you give up part of your gross salary in exchange for a non-cash benefit. Because this happens before tax and NI are calculated, you save on both:

- Reduced Income Tax (save 20%, 40%, or 45%)

- Reduced National Insurance (save 8% or 2%)

- Your employer saves 13.8% Employer NI

Use our Cycle to Work Savings Calculator to see potential savings.

Court-Ordered Deductions

These are legally enforceable and appear on your payslip as “Attachment of Earnings” or “AEO”:

- Child Maintenance (CMS/CSA) – Child support payments

- Council Tax Arrears – Unpaid local authority taxes

- Magistrates’ Court Fines – Criminal or civil fines

- County Court Judgments (CCJs) – Debt repayments ordered by court

- HMRC Tax Arrears – Unpaid tax or tax credit overpayments

⚠️ Attachment of Earnings: Know Your Rights

Employers must deduct court-ordered payments, but there are legal limits:

- Your net pay cannot fall below the “protected earnings” threshold

- Maximum deduction rates apply (typically 40% of net earnings above protected level)

- You cannot be dismissed for having an attachment of earnings order

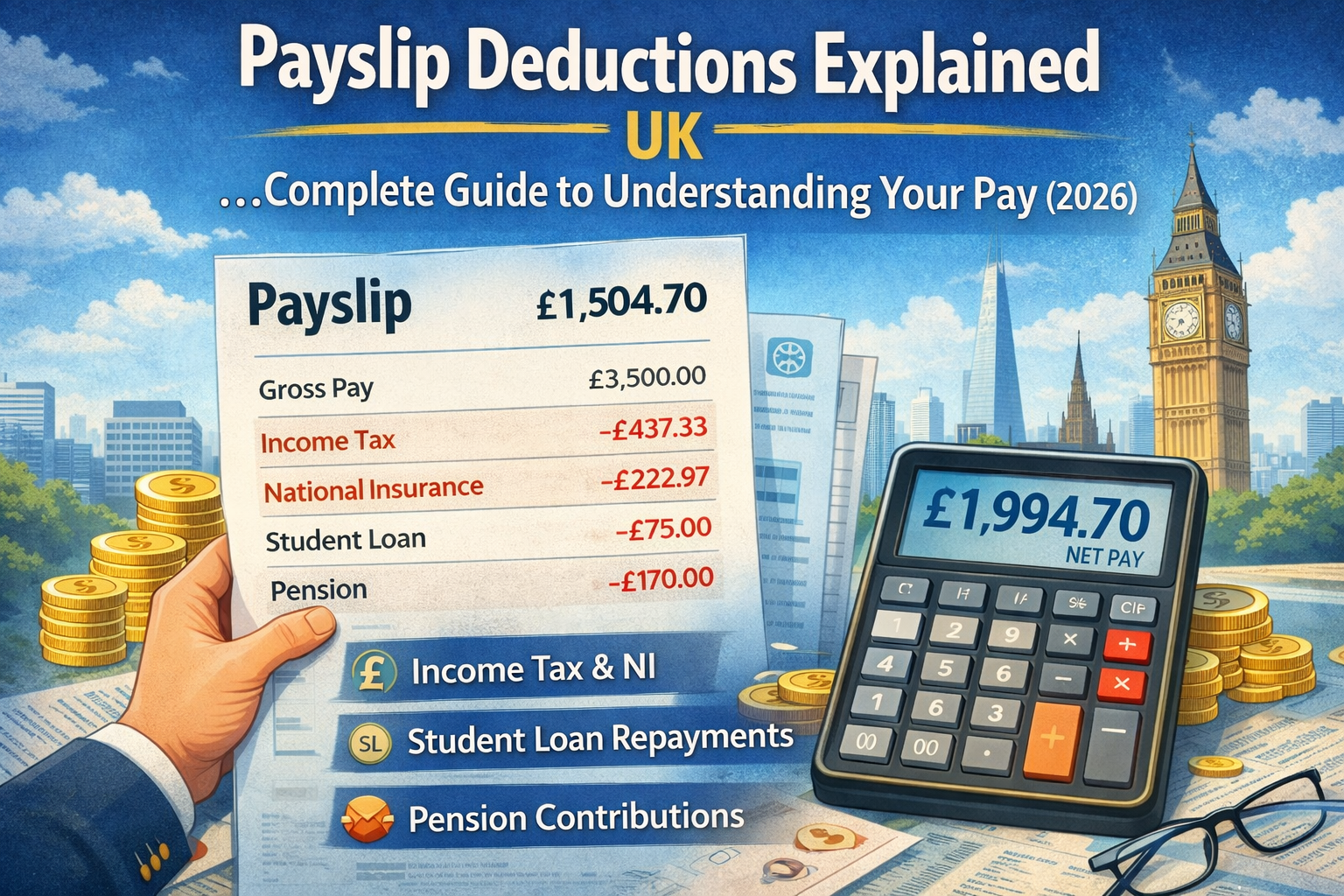

📊 Real Payslip Example: Breaking Down Every Deduction

Let’s look at a complete example payslip to see how everything works together:

Breaking Down James’s Deductions:

📊 Annual Salary: £45,000 + £1,440 overtime = £46,440

1. Income Tax (PAYE):

(£46,440 – £12,570) × 20% = £6,774/year = £564.50/month

⚠️ Note: Actual payslip shows slightly less due to timing and rounding

2. National Insurance:

(£46,440 – £12,570) × 8% = £2,709.60/year = £225.80/month

⚠️ Note: Higher on payslip due to overtime pushing into higher bracket

3. Student Loan (Plan 2):

(£46,440 – £29,385) × 9% = £1,534.95/year = £127.91/month

⚠️ Note: Lower on payslip as overtime wasn’t earned every month

4. Pension (5%):

£46,440 × 5% = £2,322/year = £193.50/month

Total annual deductions: £13,340.55

Effective deduction rate: 28.7% of gross salary

Annual take-home: £33,099.45 (£2,758/month average)

❌ Common Payslip Errors & How to Fix Them

Payroll mistakes happen more often than you’d think. According to ACAS, around 1 in 10 employees experience payroll errors annually. Here’s what to watch for:

1. Wrong Tax Code

Symptom: You’re paying too much or too little tax compared to colleagues with similar salaries.

Common causes:

- Emergency tax code (BR, W1/M1, X suffix) still applied months after starting

- Tax code not updated after leaving previous job

- HMRC hasn’t received P45 from previous employer

- You have multiple jobs and codes haven’t been split correctly

How to fix:

- Check your tax code on your payslip

- Use our Tax Code Checker

- Contact HMRC (0300 200 3300) or update via your Personal Tax Account

- HMRC will send a new tax code to your employer within 5-7 days

- Any overpaid tax will be refunded through your salary or via a P800 form

2. Incorrect National Insurance Deductions

Symptom: NI deductions seem too high or you’re paying NI but shouldn’t be (e.g., you’ve reached State Pension age).

Common causes:

- Wrong NI category letter (most employees should be Category A)

- Employer hasn’t updated records after you reached State Pension age

- System error calculating NI on bonuses or irregular payments

How to fix:

- Speak to your employer’s payroll department immediately

- If over State Pension age, provide proof to stop deductions

- For refunds, contact HMRC National Insurance helpline: 0300 200 3500

- Keep all payslips and P60 as evidence

3. Student Loan Deductions When You’ve Finished Paying

Symptom: Student loan deductions continue even though you’ve paid off your loan in full.

Common causes:

- Student Loans Company (SLC) hasn’t notified HMRC of loan completion

- Employer hasn’t received updated “stop notice” from HMRC

- Time lag between final payment and system updates (can take 6-8 weeks)

How to fix:

- Check your loan balance on the SLC online account

- If balance is zero, contact SLC: 0300 100 0611

- Request a “stop notice” be sent to HMRC

- Inform your employer’s payroll team

- You’ll receive a refund for overpayments within 6 weeks

💡 Keep Your P60 Safe!

Your P60 is issued every April and shows your total pay and deductions for the tax year. You’ll need it to:

- Claim tax refunds

- Prove your earnings for benefits or loans

- Apply for tax credits

- Check your State Pension qualifying years

Store P60s for at least 6 years—HMRC can query tax records going back this far.

4. Pension Contributions Not Appearing

Symptom: Your payslip doesn’t show pension deductions, or the amount is wrong.

Common causes:

- You’ve been incorrectly opted out of auto-enrolment

- Employer hasn’t enrolled you yet (must happen within 3 months of starting)

- Pay is below auto-enrolment threshold (£10,000/year in 2025/26)

- System error in payroll software

How to fix:

- Check if you meet auto-enrolment criteria (age 22+, earning £10,000+)

- Speak to HR or payroll immediately

- Request to be enrolled if eligible

- Contact The Pensions Regulator if employer refuses: 0345 600 1011

5. Overpayment Deductions

Symptom: Employer is deducting money because they overpaid you previously (e.g., paid wrong salary, holiday pay error).

Your rights:

- Employer must prove the overpayment occurred

- They must inform you in writing before deducting

- Repayment plan must be reasonable—you can negotiate instalments

- Deductions cannot take you below National Minimum Wage

⚠️ Don’t Ignore Overpayment Notices

If you notice you’ve been overpaid, report it immediately. If you spend the money and your employer later discovers the error, you’re still legally required to pay it back—and they may deduct the full amount from your next payslip, which could cause financial hardship.

🧮 How to Calculate Your Take-Home Pay Manually

Want to double-check your payslip is correct? Here’s the step-by-step process:

Step-by-Step Calculation

📊 Example: Annual salary £40,000, on Plan 2 student loan, 5% pension

Step 1: Start with Gross Salary

£40,000 per year = £3,333.33 per month

Step 2: Deduct Pension (pre-tax)

£3,333.33 × 5% = £166.67

Remaining: £3,166.66

Step 3: Calculate Income Tax

Annual taxable: £40,000 – £2,000 (pension) = £38,000

Above Personal Allowance: £38,000 – £12,570 = £25,430

Tax at 20%: £25,430 × 20% = £5,086/year = £423.83/month

Step 4: Calculate National Insurance

Monthly earnings above NI threshold: £3,166.66 – £1,047.50 = £2,119.16

NI at 8%: £2,119.16 × 8% = £169.53/month

Step 5: Calculate Student Loan (Plan 2)

Annual above threshold: £40,000 – £29,385 = £10,615

Repayment at 9%: £10,615 × 9% = £955.35/year = £79.61/month

Step 6: Calculate Net Pay

£3,333.33 (gross)

– £166.67 (pension)

– £423.83 (tax)

– £169.53 (NI)

– £79.61 (student loan)

= £2,493.69 take-home per month

🧮 Let Our Calculator Do the Work

Skip the manual calculation—get instant, accurate take-home pay results in seconds.

Calculate Take-Home Pay Now →💡 Tips to Maximise Your Take-Home Pay

Understanding your deductions is the first step—here’s how to legally reduce them and keep more of your earnings:

1. Claim All Tax Reliefs You’re Entitled To

- Marriage Allowance – Transfer 10% of Personal Allowance to your spouse (save up to £252/year)

- Pension Tax Relief – Increase pension contributions to reduce taxable income

- Professional Subscriptions – Claim tax back on work-related memberships

- Work-from-Home Allowance – £6/week (£312/year) tax-free if you work from home regularly

- Mileage Allowance Relief – Claim tax back if your employer doesn’t fully reimburse business mileage at 45p/mile

Use our Mileage Allowance Relief Calculator to see what you can claim back.

2. Use Salary Sacrifice Schemes

- Cycle to Work – Save up to 42% on bikes and cycling equipment

- Electric Vehicle Scheme – Massive savings on electric cars (up to £10,000+ over 3 years)

- Childcare Vouchers – (closed to new joiners, but existing members can continue)

- Tech Scheme – Buy laptops, tablets, phones tax-free

3. Check You’re Not Overpaying Student Loans

If your income fluctuates (bonuses, commission, multiple jobs), you might be overpaying. This happens because PAYE assumes your current month’s salary applies all year.

Solution: Check your SLC online account at the end of each tax year and claim refunds.

4. Understand How Pay Rises Affect Your Take-Home

Not all pay rises are equal. A £5,000 raise doesn’t mean £5,000 extra in your pocket:

| Your Situation | £5,000 Gross Raise | Actual Take-Home Increase |

|---|---|---|

| Basic rate taxpayer (20%) | £5,000 | ~£3,400 (68%) |

| Higher rate taxpayer (40%) | £5,000 | ~£2,900 (58%) |

| Higher rate + student loan | £5,000 | ~£2,450 (49%) |

| Additional rate (45%) | £5,000 | ~£2,650 (53%) |

Use our Salary Increase Calculator before accepting offers or negotiating raises.

🎯 Key Takeaways

- Your payslip must show gross pay, net pay, and all variable deductions by law

- The “Big Four” statutory deductions are: Income Tax (PAYE), National Insurance, Student Loans, and Pension Contributions

- For 2025/26, the Personal Allowance is £12,570, and you pay 20% tax on income between £12,571–£50,270

- National Insurance is 8% on earnings between £12,571–£50,270, then 2% on anything above

- Student loan deductions depend on your plan type: Plan 1 (£26,900), Plan 2 (£29,385), Plan 4 (£33,795), Plan 5 (£25,000)

- Pension contributions are deducted before tax, giving you automatic tax relief

- Always check your tax code—wrong codes are one of the most common payroll errors

- Keep your P60 safe for 6 years minimum—you’ll need it to claim refunds and prove earnings

- If you spot an error, speak to payroll immediately—delays make refunds harder to claim

- The average UK employee loses 30-35% of gross pay to statutory deductions

❓ Frequently Asked Questions

Q: How much tax should I pay on my salary in the UK?

It depends on your income. For 2025/26:

- £0–£12,570: 0% (Personal Allowance)

- £12,571–£50,270: 20% (Basic rate)

- £50,271–£125,140: 40% (Higher rate)

- Over £125,140: 45% (Additional rate)

Scotland has different rates. Use our Take-Home Tax Calculator for your exact deduction.

Q: Why is my first payslip so low?

New starters often see lower first payslips due to:

- Emergency tax code: You’re taxed at basic rate (20%) on everything, with no Personal Allowance

- Pro-rata pay: If you didn’t work the full month, your pay is reduced proportionally

- Delayed P45: Without a P45 from your previous employer, HMRC applies an emergency code

Your tax code should correct itself within 6-8 weeks, and you’ll receive a refund.

Q: Do I need to pay National Insurance if I’m over State Pension age?

No. Once you reach State Pension age (currently 66 for both men and women, rising to 67 by 2028), you stop paying National Insurance—even if you continue working full-time. However, you still pay Income Tax on earnings above the Personal Allowance (£12,570).

Q: Can my employer deduct money without telling me?

No—with limited exceptions. Employers can only deduct from your pay if:

- It’s required by law (tax, NI, student loans)

- You’ve agreed in writing (pension, union fees, loans)

- They’ve made an error and overpaid you (but must notify you first)

- There’s a court order (Attachment of Earnings)

Unauthorised deductions are illegal. Contact ACAS (0300 123 1100) if this happens.

Q: How do I know if I’m on the right student loan plan?

Check your Student Loans Company online account. Your plan depends on:

- When you started university

- Where you lived when you applied (England, Scotland, Wales, NI)

Your payslip should show the plan type (SL1, SL2, SL4, or SL5). If it’s wrong, contact SLC immediately: 0300 100 0611.

Q: What happens if I have two jobs?

Each job has a separate tax code:

- Main job: Uses your full Personal Allowance (usually 1257L)

- Second job: Usually taxed at basic rate (BR) on all earnings—no Personal Allowance

You only pay National Insurance separately on each job if it’s above the NI threshold (£12,570/year). Student loans deduct from combined income.

Use our Multiple Jobs Calculator to see total deductions.

Q: How long does it take to get a tax refund?

Refund timelines vary:

- Through payroll adjustment: 1-2 months after HMRC updates your tax code

- P800 tax calculation: Issued after end of tax year (May–November), refunded within 4 weeks

- Manual claim: Submit form, HMRC responds within 12 weeks

- Online refund claim: Decision within 5 weeks, refund 5 days after approval

Q: Should I make voluntary student loan overpayments?

It depends on your situation. Consider overpaying if:

- You’re on a high salary and will repay in full before write-off

- You’re close to paying off the balance

- You want to reduce interest charges

Don’t overpay if:

- You’re on Plan 2 with low-to-mid salary (most people never repay in full)

- You’re close to the write-off date (30 or 40 years)

- You have higher-interest debts to clear first

Read our full guide: Should You Overpay Your Student Loan?

📚 Continue Learning About UK Employment Rights

Explore more guides to protect your earnings and understand your rights:

View All Tools → Employment Rights Hub →Related articles:

- Student Loan Repayment UK 2026: Plans 1, 2, 4 & 5 Explained

- How to Negotiate Salary in the UK: Expert Tips for 2026

- How to Calculate Your Holiday Entitlement in the UK

- How to Calculate Sales Commission: Formula & Examples

Disclaimer: This guide is for informational purposes only and does not constitute financial or legal advice. Tax rates and thresholds are correct for the 2025/26 tax year as of January 2026. Always check gov.uk for the most up-to-date official rates, and consult HMRC or a qualified accountant for personal tax queries.